Table of Contents

Redundancy Philippines

Redundancy Philippines is when an employee’s services are superfluous – in other words, there are more employees than needed.

Termination for Redundancy has 4 Requirements:

- Good Faith

- Fair and Reasonable Criteria

- Written notice served to the employee and to DOLE

- Redundancy Pay Philippines or Separation Pay must be paid

I’ll go through each of these requirements in depth below.

I’ll also show a sample Redundancy Pay Philippines calculation.

Lastly, I’ll discuss what happens when Redundancy is invalid and an Illegal Dismissal penalty is awarded (what the penalties are, etc.)

Let’s begin.

What is Redundancy Philippines?

Redundancy Philippines is when there are more employees than what is needed by the company.

This may be because of over-hiring, a decrease in business volume, or a dropping in a particular line of service.

Redundancy can also occur when 2 business groups are merged, such as what occurred when 3M Philippines merged its Industrial Business Group with its Safety & Graphics Group.

In this case G.R. 248941, 3M Philippines decided to align its organization to be more market focused.

3M Philippines would have the same business model other South East Asian groups had and hopefully focus more on marketing.

This resulted in excess manpower, specifically the need for only one head of the group.

So, Termination due to Redundancy was implemented.

The evidence that 3M presented was very clear.

It was also evident that 3M acted due to business circumstances, and that Redundancy was needed.

Due to this, the Supreme Court ruled that there were sufficient grounds for Redundancy and that there was no Illegal Dismissal.

Termination due to Redundancy must be in Good Faith

Termination due to Redundancy must be in Good Faith – in other words, the company needs to go through Redundancy due to business circumstances, and not circumvent the law.

To show the court that this is the case, proof has to be presented.

Documents such as new staffing patterns, feasibility studies, studies on the viability of the newly created positions, job descriptions and the management approval of the restructuring are considered.

Supreme Court upheld the existence of Redundancy Philippines when 2 Business divisions were merged (3M vs Lauro) and when the company outsources a non-core service (WPI vs Mejila) because they were proved.

In these cases, the companies presented clear reasoning and proof that the Redundancy was a fair exercise of business judgment.

Let’s examine WPI vs Mejila as an example.

WPI decided to outsource non-core functions so that it could focus on productivity and streamline operations.

So, it closed its company clinic operations.

WPI presented proof to show that it had considered this for many years, its projection of increased sales, and a computation of cost between the clinic and outsourcing the function.

The Supreme Court upheld the validity of this Termination Philippines due to the clear reasoning and proof.

Contrast this with GMC corporation who was not able to show proof that redundancy was required.

GMC only presented proof of notice to DOLE and to the employee, the checks issued to her, and the list of other terminated employees.

The Supreme Court stated that there was no tangible proof that GMC was experiencing a slowdown (which was what the company claimed to justify Termination due to Redundancy).

The Supreme Court named items such as

- A new staffing pattern

- Feasibility studies or proposal

- Viability of newly created positions

- Job description

- Management approval of the restructuring

- Audited financial documents like balance sheets

- Annual income tax returns and others as items that would show good faith

In GMC, the Supreme Court ruled that the company showed bad faith.

The Supreme Court upheld the Court of Appeal’s Decision to award Reinstatement, Backwages and Moral and Exemplary Damages.

Thus, it’s always important to show proof or grounds for Redundancy and that it was done for the business reasons stated.

Termination due to Redundancy Requires Fair and Reasonable Criteria

For Termination due to Redundancy to be valid, the company must have fair and reasonable criteria to determine who stays and who goes.

“Fair treatment in the work force is no longer exclusively a labor issue, nor is it a women’s issue – it is a fundamental economic issue”

– Madeleine M. Kunin

Fair and Reasonable Criteria that should be considered include:

- Preferred Status (For example, Regular employees are of a higher status than part-time employees)

- Efficiency or basically a performance assessment

- Seniority or Length of Service

In 3M vs Lauro, the company showed Lauro’s 3-year performance assessment vs the retained group head.

Lauro had filed a Labor case for Illegal Dismissal.

However, the court upheld that there was valid Termination due to Redundancy.

The court took into account that Lauro’s performance assessment was inferior versus the retained employee.

Furthermore, the retained employee had more experience than Lauro.

So, Lauro’s Termination Due to Redundancy had clear criteria to determine who would be terminated.

This is in contrast to GR 181719.

In this case, Jardine had no clear criteria for Termination due to Redundancy.

Jardine was never able to present why certain employees were terminated and why others were not.

The court ruled that there were insufficient grounds for redundancy for these employees and found Illegal Dismissal.

Redundancy Philippines and Due Process: Written Notice 30 days before

Redundancy Philippine should follow due process by informing the employee and DOLE of the Termination 30 days before.

The notice must be:

- Written and should be 30 days before Termination for the employee

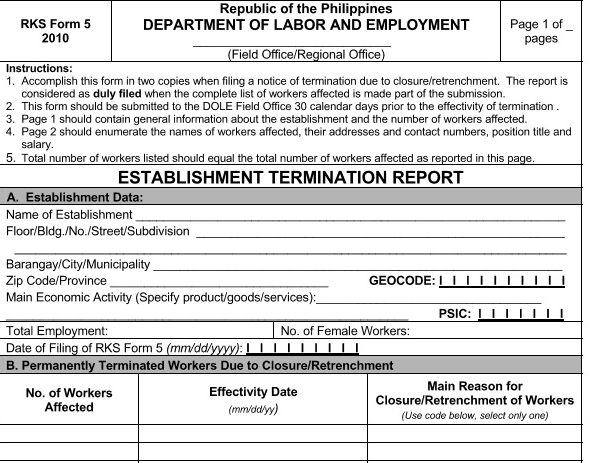

- Using the DOLE Redundancy Form and 30 days before for the company

Both should be present.

In G.R. 148132, Smart informed the employee of her Termination due to Redundancy only 20 days before.

The Supreme Court ruled that there was non-compliance with due process.

The company was penalized with Nominal Damages of Php 50,000 for this non-compliance with due process.

Now, in WPI Philippines, the defect was that the DOLE Redundancy Form was filed at the Field Office instead of the Regional Office.

The company believed that the DOLE Redundancy Form could be filed in a field office since several functions had devolved to field offices.

The Supreme Court reiterated the requirement that the DOLE Redundancy Form be filed at the Regional Office (as per Implementing Rules and Regulations of the Labor Code).

The DOLE Redundancy Form looks like this:

For this, the Supreme court assessed nominal damages of Php 50,000.

So, it is important to comply with Redundancy Philippines due process.

It can avoid fees and also the hassle of defending a company in court.

Redundancy Pay Philippines must be paid

Redundancy Pay Philippines – more properly called Separation Pay must be paid to the affected employee.

Redundancy Pay Philippines: Factors that affect Calculation

- Number of years worked with a fraction over 6 months considered a year

- 1 month of regular compensation inclusive of regular allowances per year worked.

If you have worked for your company for 4 years a 8 months and are separated due to Redundancy Philippines, you would be compensated for 5 years as 8 months is rounded off to a full year.

Then, if your regular compensation is 15,000 plus a 5,000 living allowance, the 1 month’s

regular compensation would be 20,000.

So the calculation for Redundancy Pay Philippines is:

5 years * 20,000 regular compensation = Php 100,000

You would receive Php 100,000 as your Redundancy Pay Philippines.

Note that the calculation above is for when you are separated due to Redundancy.

If you are separated due to Retrenchment, then the calculation is different.

Both Redundancy Pay and Retrenchment Pay are part of Separation Pay, and it can get very complicated.

For example, which types of allowances are considered regular?

Do contractual and part-time employees receive Separation Pay?

Our article Separation Pay Philippines is a very in-depth article on who gets separation pay, how it is calculated as well as answering Separation Pay FAQs and can help clearing this up.

Illegal Dismissal Penalty: Invalid Redundancy

A common Illegal Dismissal Penalty is reinstatement, but penalties can also be:

- Back wages

- Damages such as Moral, Exemplary and Nominal

- Attorney’s fees

The Illegal Dismissal Penalty depends on the situation and the court will ultimately decide.

Reinstatement of the employee into his former position without loss of seniority and privileges can occur.

Reinstatement may not be possible in some situations – i.e. the company has closed, or the working environment is too strained.

In cases where Reinstatement is not possible, the court can decide to award Redundancy Pay Philippines instead.

Redundancy Pay or Separation Pay is when an employee was separated and affords him time to pay for regular expenses when he looks for work.

Redundancy Pay Philippines is thus very different from backwages.

Backwages are awarded as remuneration for the employee’s lost income from the erring employer due to Illegal Dismissal. [GR. 204060]

Back wages are the monthly compensation from the time of dismissal up to the Court’s Decision.

Backwages are paid for a different reason from Separation Pay and so may be awarded together or singly.

Damages can be awarded when there is bad faith

Nominal damages are paid when procedural due process is not followed.

So, Nominal damages might be awarded when the DOLE Redundancy Form is not filed or when written notice was not given to the employee.

A common reason to award Attorney’s fees is due to the unlawful withholding of wages. Full list here.

Attorney’s fees are not awarded all the time so it does depend on the situation.

Attorney’s fees can be about 10% of the total monetary award.

The awards given very much depend on what the Court decides – but labor cases can be very involved and labor intensive.

It’s really always best to consult with a Philippine Labor Lawyer if you are filing or defending your company in a Labor case, so you know what to expect.