Table of Contents

Maternity Leave Philippines: Law, Calculation, and FAQs

Maternity Leave in the Philippines is a legislated benefit to allow mothers to attend to their new child and themselves with paid leave.

I’ll discuss Maternity Leave Requirements, how long it is, how to avail of it, who is entitled to it as well as the 2 Maternity leave laws on which it is based.

I’ll also discuss a lot of the common FAQs.

Let’s begin.

Maternity Leave Law in the Philippines

a woman shall be granted only one maternity benefit, regardless of the number of offspring/children per delivery. – (Sec. 6, Rule V, RA 11210 IRR).

The Maternity Leave Law in the Philippines is based on RA 8282 amended by RA 1120.

RA 8282 was enacted on May 1, 1997 to strengthen the Social Security System.

Among its provisions was the Maternity Leave Benefit, specifically discussed in SEC. 14-A which granted a 60 or 75 day paid leave benefit to eligible employees.

RA 11210 in 2018 increased this benefit to 105 days or more (depending on the situation) and expanded it to include all pregnancies regardless of status.

These 2 Maternity Leave Laws form the basis of the current benefit in the Philippines.

Who is entitled to Maternity Leave in the Philippines?

Maternity Leave Philippines: Coverage

- Female workers in the public sector

- Female workers in the private sector

- Female workers in the informal economy

- Female Voluntary Contributors to the SSS

- Female National Athletes

As you can see the coverage is extensive, fulfilling the national governments desire to promote the welfare of working women.

And the benefit is given regardless of civil status, employment status, legitimacy of the child and number of children, so it is really comprehensive.

(The new Maternity Leave Law really expanded the coverage – before it was limited to the first 4 pregnancies, etc.)

Note that —

There are slight differences in how Philippine Maternity Leave is given which depend on whether the employee is public or private, the situation and whether the Maternity Leave Requirements are fulfilled.

What are the Maternity Leave Guidelines for employees in the private sector?

Maternity Leave Philippines: Quick Guidelines:

- Should have 3 monthly contributions to the SSS 12 months before the semester of the childbirth, miscarriage or emergency termination

- Should have informed SSS (through employer if employed) or by yourself if you are a voluntary contributor, separated or terminated to the SSS

- No advance notice is required in case of medical emergency but notice after the fact must be given.

Just because you have paid SSS contributions before, this does not mean that you are automatically eligible.

SSS Maternity Leave Rules states that you need to have paid at least 3 contributions in the 12 months proceeding the semester of your expected delivery.

So, say you are supposed to give birth February 2022.

February 2022 is in January 2022 to June 2022, which is the first semester of 2022.

You should have paid at least 3 SSS contributions 12 months before the first semester of 2022, in other words from January 2021 to December 2021.

If you did not pay these 3 SSS contributions, then you are not eligible for the benefit for Maternity Leave in the Philippines.

If you are a Philippine HR, remember to put together the information you will need to report to the SSS. Check the below steps on how to process it.

How do I avail of Maternity Leave in the Philippines?

If you’ve been wondering how to of Maternity Leave in the Philippines (Or if you are a Philippine HR), you will be relieved to know that it is a 2 step process.

Maternity Leave Philippines: 2-Step Process

Step 1: Notify the SSS of the pregnancy through your workplace for employees or directly if you are terminated, self-employed or a voluntary contributor.

Step 2: File the application for Maternity Leave Reimbursement.

Both of these steps can be done online or in person.

If you are a Philippine HR, please remember to keep complete documentation. You will need this later.

Step 1: Notifying the SSS of the pregnancy

If you are employed, you would notify your employer and your HR would submit this Notification to the SSS.

You should submit this within 60 days after the date of conception as per SSS Maternity Leave Guidelines.

Your employer would generally fill up a form or submit the request online.

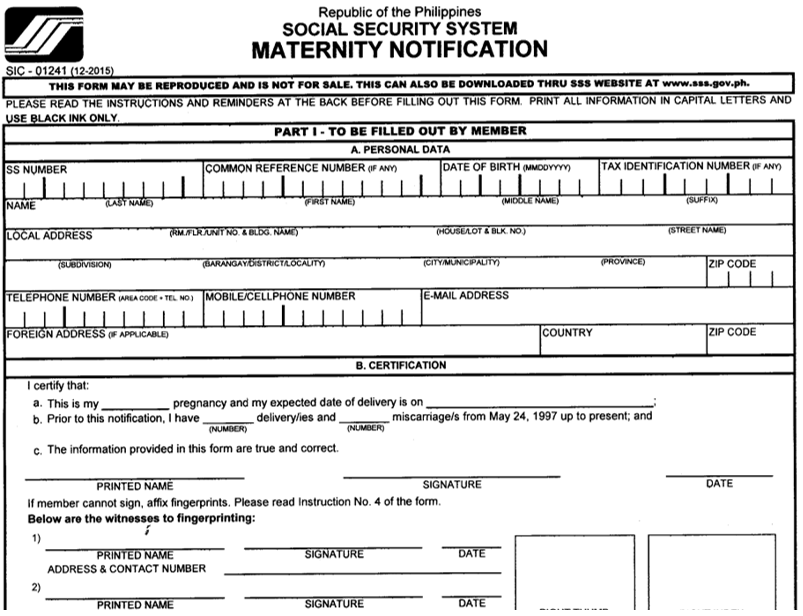

Below is what the Maternity Leave Notification Form looks like.

The Maternity Notification Form would be submitted along with the following Maternity Leave requirements:

- The above-mentioned Maternity Notification Form

- Proof of pregnancy such as an ultrasound

- 2 valid IDs with photo and signature that should not be expired

If you are employed, your employer would take off submitting these requirements at the SSS Branches.

If you are not employed you would have to submit these Maternity Leave Requirements yourself.

There are 3 ways to submit the Maternity Leave Requirements to notify the SSS as per SSS Maternity Leave Guidelines.

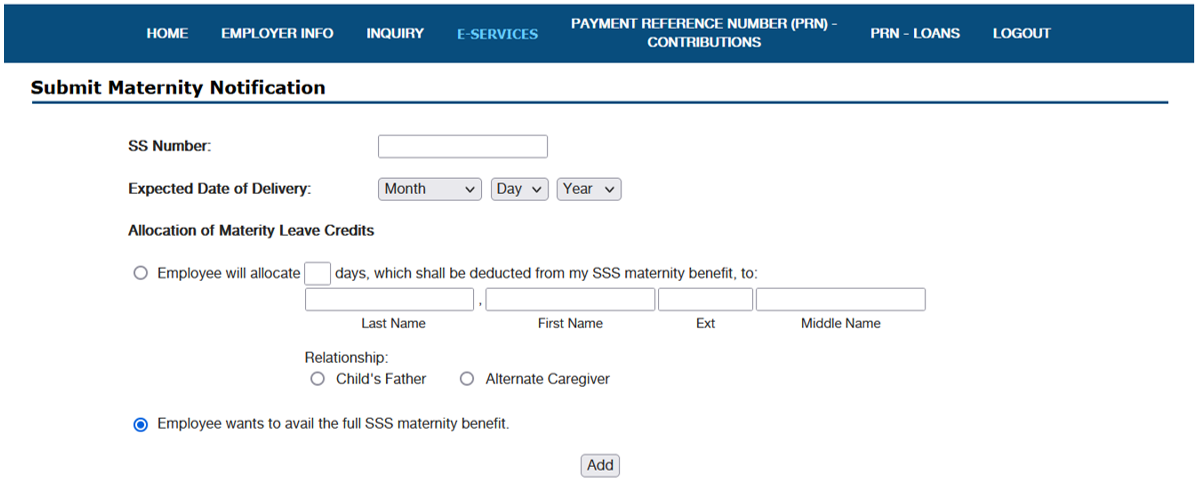

Option 1: If you are a member or employed, you can submit your maternity notification through the SSS website

- Go to the SSS Portal at sss.gov.ph

- Log into your account.

If you do not have an account, you will need to create one.

- You will see a Main Menu. Choose Maternity Notification.

- Enter your information and choose to submit.

- Make sure you keep the transaction number. You should also get an email notification.

- I suggest you print it so that you have proof that you submitted the Maternity Notification. The SSS has a lot of transactions – if you need to show proof that you did submit it you will be prepared.

Option 2: If you are a voluntary contributor, you can submit through an SSS kiosk

- Go to an SSS kiosk

- You will need to scan your SSS card.

- You will need to put your fingerprint on the fingerprint scanner.

- You will see a Main Menu. Choose Maternity Notification.

- Enter your information and choose to submit.

- You should get an Acknowledgement Receipt – please keep this you may need to show proof.

Option 3: Through text

- Text 2600 in the following formats

SSS REG <SSS Number> <Date of Birth>

SSS MATERNITYNOTIF

- You will have a PIN, which you must keep for your next transaction.

You can choose from the above applicable options so that you can submit your Maternity Leave Requirements for SSS Notification easily.

There are 2 things to remember.

One is that just because you have submitted the requirements, it does not mean that your request is granted.

The second is that you must keep proof that you notified the SSS so that you can later claim your Philippine Maternity Leave Benefit.

The SSS handles a lot of transactions and so it’s really best to be prepared.

Step 2: File the application for Maternity Leave Reimbursement

You will need to file for Maternity Leave Reimbursement so that the money will be released.

You must have first filed the Maternity Leave Notification above.

According to SSS Maternity Leave Rules, there are 2 Options to submit reimbursement requests.

Please note Philippine HRs:

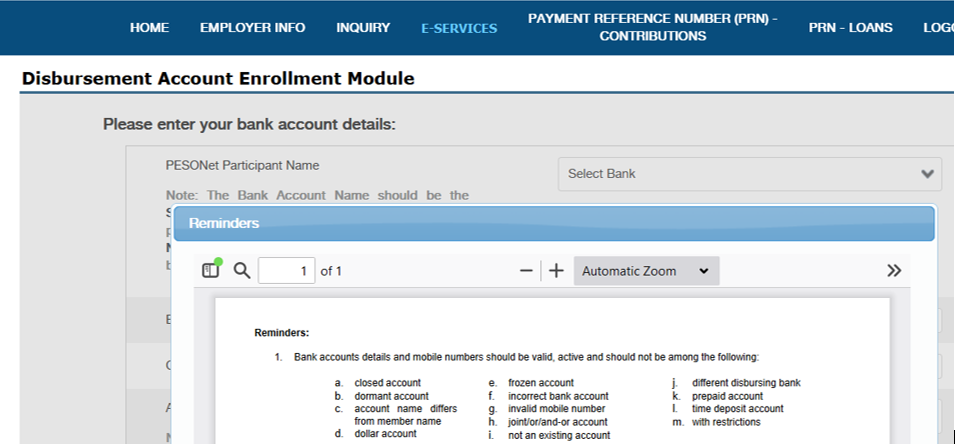

You can only do this online if you have already enrolled an account in the Disbursement Account Enrollment Module:

Option 1 Maternity Leave Philippines: Reimbursement Online

- Go to the SSS Website

- You should have a Disbursement Account – in other words, a bank account/e-wallet so that the SSS can transfer your Maternity Leave to you.

You can get this at most banks, e-wallets, etc.

Basically, any institution that can remit to you usually offers this.

- Log in.

- Under E-Services, you should see an option for Maternity Reimbursement.

- Answer the questions and move on to submitting the documents required. There are several Maternity Leave Requirements – I’ve listed them down in the next section for easy reference.

- Submit the information.

- Print out the transaction details and do the same for the SSS confirmation email.

Option 2 Maternity Leave Philippines: At an SSS branch.

- When you submit onsite, you will need to bring your documents and also make sure you have read a bank account/e-wallet or other method that the SSS can you to give you your Maternity Leave.

- I would advise that you fill up the Maternity Leave Reimbursement form before you go and have several copies of the Maternity Leave Requirements that I’ve enumerated in the next section. Bring proof that you notified the SSS as well.

- There will be a queue number at the SSS and you will need to line up and have your documents accepted and assessed.

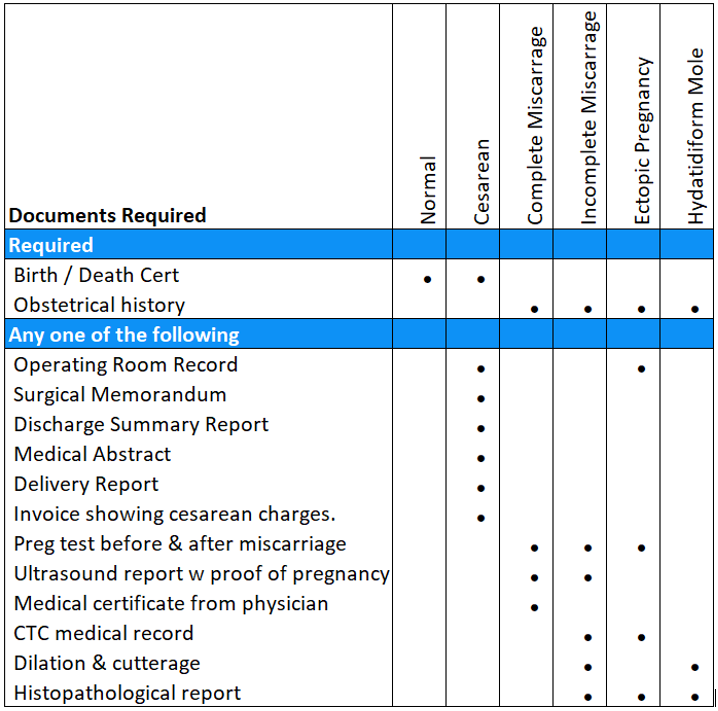

What are the SSS Maternity Leave Requirements that are submitted with the Reimbursement Request?

Maternity Leave Philippines: Basic Documentary Requirements

- SSS Notification submitted

- SSS Application form for Voluntary Members / for Employers, the SSS Reimbursement form must be filled up

- Medical documents supporting the application for Maternity Leave Benefits in the Philippines.

Maternity Leave Philippines: Additional Documentary Requirements

- If you are separated, you will need a Certificate of no advance payment by the employer and a Certificate from the employer stating separation with a separation date

- For solo parents, you will have a solo parent ID issued in the last 2 years and a certificate of eligibility from the LGU

- For deceased members, a caregiver may avail of the benefits by submitting a Certificate of Undertaking Form of a Qualified Caregiver, and the Death Certificate/Medical history of the deceased member.

Maternity Leave Philippines: Medical Documents Required

Your employer should process this for you if you are employed.

If you are a SSS voluntary contributor, you must process this yourself.

When I was working in HR, I noticed how long it took for the SSS to actually disburse the Maternity Leave.

Do yourself (or your company) a favor – request it as early as you can.

And make absolutely sure that you have completed ALL the Maternity Leave requirements, as otherwise, processing might be even more delayed.

What is the Maternity Leave Computation?

If you are trying to figure out how to calculate Maternity Leave Benefits, you will need to figure out your Average Daily Credit (Salary) for the months that you paid SSS.

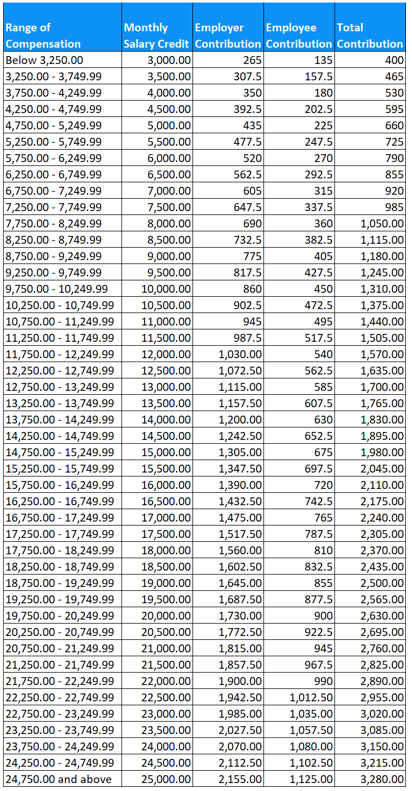

Step 1: Get the monthly salary credit – this is the basis for the Monthly Leave Computation.

First, you must get the 6 highest SSS contributions that you paid in the 12 months immediately proceeding the semester of the expected delivery.

Say, the expected delivery date is March 2022.

A semester is basically the first 6 months of the year and the last 6 months of the year.

Since March 2022 is in the 1st semester of 2022, you would need to get the SSS contributions for January to December 2021.

Get the 6 highest paying months for which you paid SSS and find the associated Monthly Salary Credit.

The Monthly Salary Credit is the basis for your SSS Maternity Leave Calculation – make sure you do this right.

See the below SSS 2022 Contribution Table as a reference.

Step 2: Get the Average Daily Credit

Step 2: Get the Average Daily Credit

Add the associated Monthly Salary Credit together for your 6 highest paid months and divide by 180.

This will give you the Average Daily Credit.

So, if you were paid Php 30,000 a month, your monthly salary credit would be Php 20,000 as all salaries over Php 24,750 have a maximum salary credit of Php 20,000 as per SSS Maternity Leave Guidelines.

If you had 6 months of this, your Average Daily Credit is:

20,000 x 6 = 120,000

120,000 / 180 = 666.67

Step 3: Multiply the Average Daily Credit by the number of days applicable to you

- 60 days for miscarriage or emergency termination

- 105 days for live childbirth

- 120 days for solo parents

So, multiply the above 666.67 x 105 days for regular childbirth.

666.67 x 105 = 70,000

You would get the maximum benefit possible in this Maternity Leave Calculation for live childbirth, which is Php 70,000.

Maternity Leave Philippines FAQs

What are the SSS Maternity Requirements for Solo Parents?

Maternity Leave Philippines: Full list of Solo Parent Requirements

If you want to avail of the additional paid 15 days from SSS, you will need to submit more documents.

- Solo Parent ID issued in the last 2 years and signed by the social worker and the mayor.

Certificate of Eligibility signed by the Mayor (you can get this at the local government unit/city hall.

What do I do if I was denied my SSS Maternity Leave Benefit?

When you are facing a denied SSS Maternity Leave Benefit or there is an unclaimed SSS Maternity Leave Benefit, you can file for reconsideration or to claim this benefit.

For both the HR or the voluntary member, this is usually done at the SSS branch itself.

As before, you would make sure that you have all the Maternity Leave Requirements, which I’ve listed in the above section.

Go to a SSS branch (if you are a Philippine HR, you would go to the SSS branch that services your company), and present your documents.

You will have to queue and go to the correct window and as before make sure that you keep proof that you have filed the Philippine Maternity Benefit to be claimed/reconsidered. This is usually an acknowledgment stub.

You will really need to follow up with the SSS – try to call if you can but it is often very busy or no one picks up the phone, so sometimes it is just best to go.

What do I do if the SSS Maternity Leave benefit is less than the “should-be” Maternity Leave Calculation?

In case the SSS Maternity Leave benefit given is less than the should be SSS Maternity leave computation, you can request readjustment on the SSS portal.

Maternity Leave Philippines: Steps for Reconsideration of Maternity Leave Amount

- Go to the SSS portal.

- Under E-services, you should see a link called Adjustment of Maternity Benefit.

- It will ask you to fill up the information and upload documents, after which you will click submit.

- Keep the transaction number and the email notification.

If you don’t know how to calculate Maternity Leave Benefits, I will explain it in this section.

What is the maximum amount for Maternity Leave in the Philippines?

Maternity Leave Philippines: Maximum Amounts

- 60 days: 40,000

- 105 days: 70,000

120 days: 80,000

What is the Salary Differential in Maternity Leave?

The salary differential in Maternity Leave is the difference between the SSS benefits that you receive and your salary.

In the above example, the monthly salary was Php 30,000 but the Monthly Credit was only Php 20,000 (SSS Maternity Guidelines follow the SSS contribution table).

The difference of Php 10,000 is the salary differential.

This salary differential will be answered for by your employer.

How long is Maternity Leave in the Philippines?

The number of days of Maternity Leave depends on the situation.

Maternity Leave Philippines: Number of days by a situation

- 105 paid days for live childbirth

- 60 paid days for miscarriage or emergency termination of pregnancy

- Additional 15 paid days for female workers who qualify under the Solo Parent’s Act

- Additional 30 unpaid days, upon request which must be requested at least 45 days before the end of maternity leave RA 11210, Sec 5 (b)

The number of days can be extended if you are an eligible Solo Parent or if you choose to go on additional Maternity Leave without pay.

Does Maternity Leave in the Philippines include weekends?

Yes, weekends are included when counting Maternity Leave and 105 days refers to the number of calendar days from when an employee goes on leave.

Leave must be continuous however – once you go on leave, you must complete it.

When can I avail of Maternity Leave?

Maternity leave can start even before the pregnancy with the earliest being 45 days before the delivery since the law requires that postnatal care be no less than 60 days.

You can go on leave any time on or before 45 days before the delivery.

Remember that once you go on leave, it should be continuous and uninterrupted – in other words, you cannot take leave and then go back to work for a few days and then go on leave again.

How many children/pregnancies does the SSS Maternity Leave benefit cover?

The SSS Maternity Leave benefit covers all children/pregnancies – which is a very big difference from the 1997 law, which only covered up to 4 pregnancies.

Can I avail of Maternity Leave in the Philippines even if I am unmarried?

In GR 234186, a concurring opinion to the decision states “The labor code does not distinguish between married and unmarried family employees for purposes of availing of Maternity Leave privileges.”

In RA 11210, Sec III of the Expanded Maternity Leave Law, it states that the grant or coverage is “All covered female workers … regardless of civil status …”

So, if you are unmarried you can still avail of Maternity Leave in the Philippines.

Can I convert my Philippine Maternity Leave Benefit to Cash and still keep working?

No, you cannot convert your maternity leave benefit to cash.

If you avail of Maternity Leave in the Philippines, it will only be paid if you are on leave because the purpose is to ensure that you are provided for while you are giving birth and the immediate weeks after that.

Is Maternity Leave in the Philippines cumulative?

No, Maternity Leave in the Philippines is not cumulative – in other words, the benefit is lost if you do not use it.

Can I avail of SSS sickness benefit and SSS Maternity Leave at the same time?

No, you cannot avail of both SSS Sickness and SSS Maternity Leave at the same time.

RA 11210, Sec 5 of the Expanded Maternity Leave Law says that “The payment of daily maternity benefits shall be a bar for the recovery of sickness benefits for the same period for which daily maternity benefits have been received.”

Can I avail of PhilHealth Maternity and SSS Maternity Leave in the Philippines at the same time?

Yes, you can avail of PhilHealth Maternity and SSS Maternity Leave benefits at the same time.

Can my husband apply for SSS Maternity Benefits in the Philippines for me?

No, your husband cannot apply for SSS Maternity Benefits in the Philippines for you.

Only the female SSS Member can apply as per SSS Maternity Leave Guidelines.

Can I get Philippine Maternity Leave after the birth of my child?

Yes, you can claim Maternity Leave in the Philippines up to when the child is 10 years old.

Can I still avail of my SSS benefit if I was terminated?

Yes, Philippine Maternity Leave Benefits can still be redeemed even if you were terminated.

Remember to add 2 additional requirements to the Maternity Leave Requirements I mentioned up top.

- Notarized Certificate that the employer did not advance any benefit yet

- Notarized Certificate from employer that you are separated with your last date.

Can I claim the Philippine Maternity Leave Benefit of a deceased member?

Yes, you can claim the unclaimed benefits of a deceased member.

You must submit the following additional Maternity Leave Requirements for a deceased member:

- Certificate of Undertaking of Caregiver notarized

- Death Certificate of the Deceased Member or medical history

1 Comment

Your comment is awaiting moderation.

AIs can increase testosterone by reducing the negative feedback on the HPG axis via a reduction in serum estrogen, thereby increasing gonadotropin levels [url=https://fastpriligy.top/]buy priligy 60 mg[/url]

Your comment is awaiting moderation.

buy priligy 30 mg x 10 pill MAL VIP17 is expressed in TALs, distal convoluted tubule, and collecting ducts 106

Wonderful post! We are linking to this great content on our website.

Keep up the good writing.