Table of Contents

What is an Extrajudicial Settlement with Deed of Sale?

An Extrajudicial Settlement with Deed of Sale is a notarized document that transfers property from a deceased owner who does not have a will to a buyer with the consent of all the heirs. It must be settled within a year otherwise to avoid annual tax penalties.

An Extrajudicial Settlement with Deed of Sale must:

- Be a notarized document

- Be accompanied by all asset documents such as the Original Owner’s Title, Vehicle Registration, etc.

- Be signed by all the heirs

- The buyer must be an actual buyer willing to go through this process with you – if you just want to sell and have buyers who are interested but haven’t settled on one or that buyer is not willing to go through this process, then you are better off doing an Extrajudicial Settlement

It is a combination of an Extrajudicial Settlement and a Deed of Sale and is a good option since an Extrajudicial Settlement with Deed of Sale completes both the EJS and the Deed of sale in one document.

When you settle an estate you transfer it to the heirs.

When you sell an Ordinary Asset you transfer it to the buyer.

However, when you do an Extrajudicial Settlement with Deed of Sale, you transfer directly to the buyer, so avoid the difficulty of 2 transfers.

Why do I need to settle the estate?

Settling the estate is important because it allows the transfer of the titles to the new heirs or owners.

Without settling an estate, a land title cannot be transferred to the heirs.

Without settling an estate, a land title cannot be transferred to the buyer.

If the title is not in your name, you cannot reap the full rewards of being an owner.

What are the requirements for Extrajudicial Settlement with Sale?

The requirements for Extrajudicial Settlement with Sale are that you must have an actual buyer with the amounts agreed, agreement amongst the heirs and all the property documents.

- An actual buyer and agreed prices. If you just want to sell but have no buyer, you had better do just an Extrajudicial Settlement

- Notarized EJS with the signature of all the heirs, authenticated if heirs are abroad

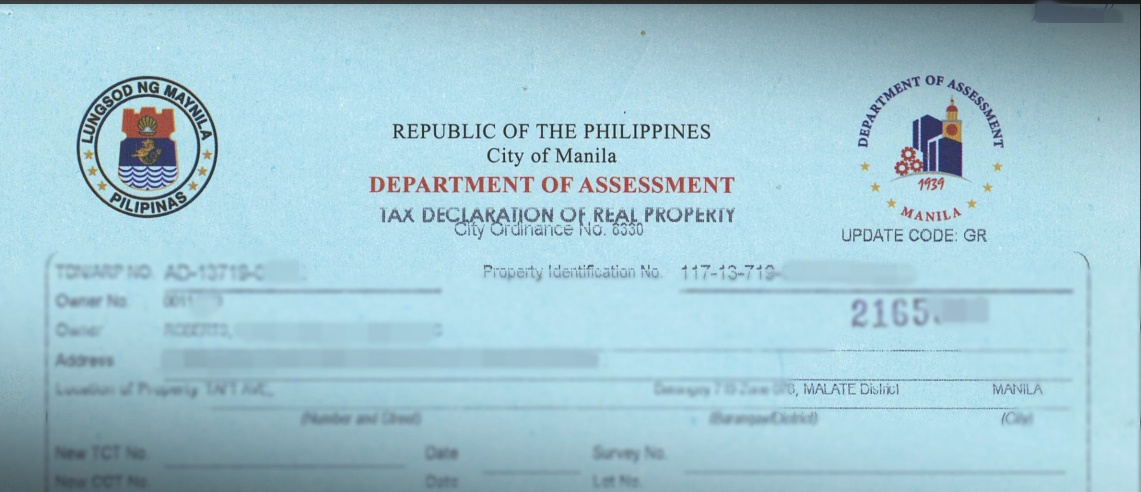

- Property documents such as Original Owner’s Title, Certified True Copies of Title, Tax Declarations, Certified True Copies of Tax Declarations, Certificate of Landholdings, Certificate of No Improvement, Certified True Copy of Mortgages and SOA from the Bank

- Stock documents such as Owner’s Stock Certificates and Audited Financial Statements, if unlisted

- Vehicle documents such as Owner’s Registration for a vehicle

- PSA death and marriage certificates of deceased

- PSA birth, marriage and death certificates of heirs

- TINs and IDs of all involved showing current signature and photo

- Payment of all realty taxes

- Certification from a registered accountant if estate is more than 5M

Please note –

One of the requirements for Extrajudicial Settlement with Sale is that there must be an identified buyer with an agreed-upon price.

If you just want to sell the property but don’t have a specific buyer, do an Extrajudicial Settlement instead.

Also note –

Another one of the requirements for Extrajudicial Settlement with Sale is that all the heirs must sign. If some heirs disagree, you will need to discuss this with an Inheritance Lawyer because you may end up going to court. It is best to avoid court.

Lastly –

So many estates are never settled because of a lack of documents.

While you can pay estate taxes with just a tax declaration, you will need the Original Owner’s Title so that the property can be transferred to the buyer. And sometimes documents as simple as a birth, marriage or death certificate can result in a PSA Certificate of No Record.

Even if documents are available, a lot of documents have issues with the names being improperly spelled or inconsistencies. This can also cause issues.

In our FAQ below, we answer common issues we find such as:

- Who are the heirs?

- Do all owners of a property have to agree to sell in an Extrajudicial Settlement with Deed of Sale?

- What if you do not have the original land title?

- What if you do not have any documents at all?

- What if the tax declaration is in someone else’s name?

- And other common FAQs, such as if you can sell the property without settling the estate, whether a co-owner can sell part of an estate, etc.

Hopefully, this will help you understand what needs to be done.

What is the process for an Extrajudicial Settlement with Deed of Sale?

The process for an Extrajudicial Settlement with Sale is that the documents are gathered, submitted to the BIR, and then transferred by the appropriate government agency – exactly the same as a regular Extrajudicial Settlement.

I’ll summarize the Extrajudicial Settlement with Deed of Sale process below, just in case you are not familiar with it:

- Gather ALL the documents

- Inheritance lawyer drafts Extrajudicial Settlement with Deed of Sale

- ALL the heirs sign the Extrajudicial Settlement with Sale and it is notarized and authenticated, if the heirs are abroad

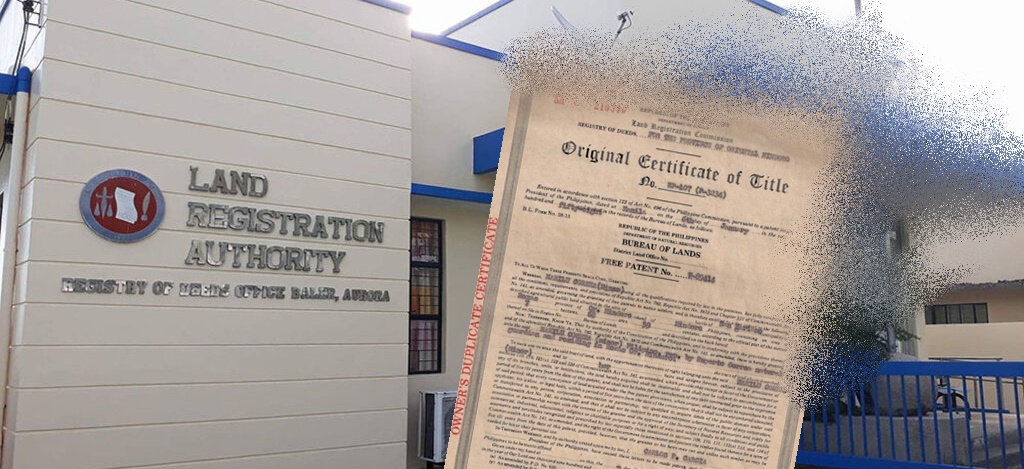

- Documents are submitted at the BIR

- BIR estate taxes, capital gains taxes and document stamp taxes are paid

- E-CAR is submitted to the Registry of Deeds and titles are transferred or to the applicable government agency (LTO for vehicles, etc.)

It’s deceptively simple, I know.

But because gathering the documents can take months due to the issues we always find in them, the process can easily take up the entire allocated year.

Remember though that you need to rush since Estate tax penalties do happen.

If the estate is not settled after a year for deaths on Jan 1, 2018, and after, then BIR penalties are added to the BIR estate taxes on every anniversary of the death.

What is the cost of an Extrajudicial Settlement with Deed of Sale?

The cost for an Extrajudicial Settlement with Deed of Sale is 6% of the net estate and the 6% on the same, plus the cost of gathering the documents.

Your possible costs are detailed below:

- Inheritance Lawyer’s fee

- Accountant’s fees (this is one of the requirements for an Extrajudicial Settlement with Sale if the estate is more than 5 million)

- Estate taxes of 6% on the net estate

- Capital gains of 6% on the sale

- Document stamp tax of 1.5%

- Document gathering fees

- Transfer fees at the Registry of Deeds or applicable agency

- Payment of unpaid realty taxes

- BIR Late fees are added every year that the estate is not settled, so settle it as soon as you can.

Let’s talk about the BIR Estate Taxes.

BIR estate taxes are one of the major requirements for extrajudicial settlement with the sale and must be paid – you cannot settle an estate without paying it.

The amount of BIR Estate Taxes depends upon when the person died.

Prior to TRAIN, there were something like 8 different estate tax laws that are to be applied depending on the date of death.

For example, if the deceased passed away on June 3, 1976, the applicable estate taxes are those from PD 69.

But if the death was after Dec 31, 2018, then the TRAIN laws apply.

Currently, the effective BIR Estate Tax calculation is as follows:

- Estate taxes are 6% of the net estate

- Standard deduction of 5 Million

- Family home of 10 Million

- Surviving spouse shares the conjugal property

- For properties previously taxed and transferred within 5 years, there are some deductions in light of previously paid taxes

This can be a little complicated – it’s best to consult with an Inheritance Lawyer so that he can tell you the best ways to reduce the BIR Estate taxes.

Please note that an Inheritance lawyer cannot calculate the exact BIR Taxes during an initial consultation because he would need all the documents as well as new documents that he needs to get from the government. Your lawyer would need to study the case to get an exact cost, which most can only do after getting all the documents, and all the information and spending some time on it.

FAQs on Extrajudicial Settlement of Estate

Who are the legal heirs of a deceased person in the Philippines?

If a person has a Will, then the Will determines the heirs but must still respect the laws on Disinheritance, Compulsory heirs and Rules on Notarial and Holographic Wills.

If a person does not have a Will, the laws on Compulsory Heirs will be followed.

Compulsory Heirs are those who the law states must inherit unless validly disinherited or otherwise removed; for example, a legal spouse no longer inherits if annulled.

Do all heirs have to agree to sell property in the Philippines?

An heir can sell his part of the property, if he wishes.

But to transfer to the new owner’s name, the property must be subdivided so that the portion that is being sold can be titled to the new owners.

Do all the heirs have to sign the Extrajudicial Settlement with Sale?

Yes, one of the requirements for extrajudicial settlement with sale – or for all extrajudicial settlement is that all heirs sign.

If not all the heirs agree to the sale, then try to do an Extrajudicial Settlement instead or subdivide the property.

Just remember that to settle any estate all the heirs must sign.

(Remember to settle the estate as soon as possible because each year late fees will be added to the estate taxes if the estate remains unsettled and this can be very, very expensive.)

What if one of the heirs is abroad?

If one of the heirs is abroad, it can be more challenging logistically since he will have to sign, notarize and then authenticate the Extrajudicial Settlement with Deed of Sale abroad before it can be used in the Philippines.

But still, all the heirs must sign – it is one of the requirements for extrajudicial settlement with sale or any EJS for that matter.

Can a property be sold without an Extrajudicial Settlement?

Yes, but it cannot be transferred to the new owner’s name unless the estate is settled.

Serious buyers and businesses will want the estate settled before they buy, and will often pay a higher price because the land is correctly titled.

What if you do not have the original land title?

If you do not have the Original Owner’s Title (not a photocopy), then you will need to go to court in a Reissuance case so that a new owner’s copy can be given to you.

What if you do not have any documents at all?

If you do not have any documents at all – say you just have a name and an address, be prepared to spend money and time on getting the documents.

If it is land, first go to the Registry of Deeds where the property is located and get the following documents for the name of the deceased:

· Certified True Copy of Title

· Certified Tax Declarations and Tax Computation

· Certificate of Land Holdings

That will check first if the property is in the name of the deceased and give you a very good place to start gathering the other documents and contacting ALL the heirs so that they sign the EJS or help settle the property.

What if the tax declaration is in someone else’s name?

If the tax declaration is in a name other than the deceased but the land title is in the deceased’s name, it must be transferred first so that the tax declaration can then be transferred to the new heirs or owners.

To transfer a tax declaration, you will have to show proof that it was bought, inherited or otherwise acquired by the deceased.

This may mean that you need to show a Deed of Sale or a previous EJS.

Can you do this without an Inheritance Lawyer?

Yes, supposedly you can do this without an Inheritance Lawyer, but I’ve never actually seen anyone do this without one.

Because the requirements for Extrajudicial Settlement with the sale are numerous and because there are so many difficulties gathering the documents, it is very, very, very hard to do by yourself.

With an Inheritance Lawyer, you are guided and have a better chance of succeeding.

6 Comments

Does it take long to file?

It generally takes a long time to gather the documents, since there are a lot of documentary requirements.

Your comment is awaiting moderation.

Awwww, My Ex and I are back together ……thank you, [fixmybrokenmarriage […] gmail com].

Your comment is awaiting moderation.

We already have an EJS signed by the heirs, notarized and published since 2019, already paid the Estate tax in 2022, we are selling the property and we already have a buyer, is it ok to make a Deed of Absolute Sale only and not DOAS with EJS?

thanks

Your comment is awaiting moderation.

My father died in January 2012, but his great father left him a land totaling 300 square meters. Now we must transfer land title to my brother’s name or to my own. Only the land location and sketch are given to me/my brother. However, I have already constructed a tiny house. From my perspective, how will I apply land title transfer?

I have some lot properties located in Bacnotan La Union, Philippines and a house and lot located at Quezon City as well. Titles and Tax declarations of these properties are under my name and my wife. My wife died in April 2019 at Ontario, Canada and I bring her cremation and buried her in La Union. I have tried applying for an Extra Judicial Settlement at RDO 39 in Quezon City but unfortunately, I was unable to have it completely processed due to lack of some documents that I was unable to submit and follow up due to the pandemic.

I was unable to obtain a certified true copy of my Owner’s copy of my lot Titles from the Register of Deed in San Fernando, La Union as the Reg. of Deed declared that said Office was destroyed by fire sometime in the year 2000. Instead, they required me to obtain a Reconstitution of these properties from the LRA Office in Quezon City. I complied and have submitted all the requirements to have these properties reconstituted but again majority of paper work documentations gone stray due to pandemic again and I was not able to personally follow up to update myself on their current status and standing.

Based on the above circumstances, please held and advise me how I can have it extra judicially settled and sell these properties.

Thank you. Restituto Cariaso

Sent you an email.

We have a family home. Father put the land to my sister’s name, house or bldg his name unfortunately both of them passed 6 months apart now my brother in law gave me back the title and gave me a POA he doesn’t want it. Can I get an extra judicial settlement from my dad’s property btw this is in Philippines. My brother lives in Missouri sister in Long Island NY myself in Texas. If ever I get the EJSE do I have to include my brother in law’s name.

Sorry for the late reply. You have to get all the heirs to sign the EJS document. Compulsory heirs must sign off so that the property can be transferred to your name.

Your comment is awaiting moderation.

My husband died 2014. His land title was mortgage to his uncle 2011 ang agreed to a 10 year contract. 2018 his uncle built a house. We agreed to sell both the lot and the house for 1.4m and got half of the selling price. Is it necessary to put in the Deed of Absolute Sale the details of the house? Please help me. Thanks.