Table of Contents

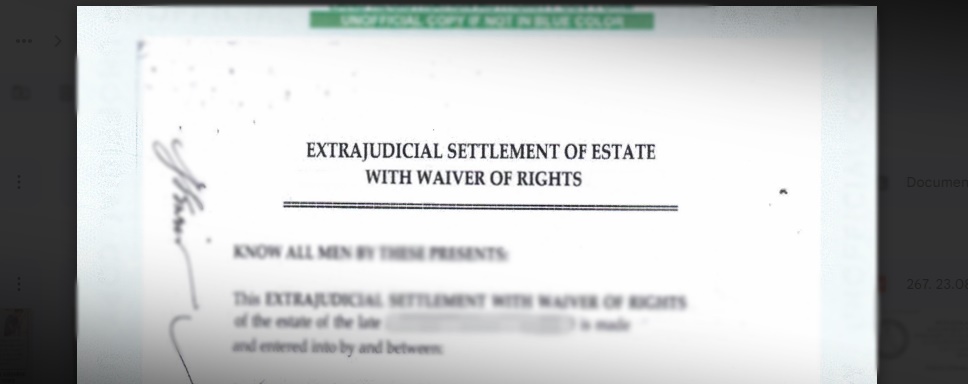

What is an Extrajudicial Settlement with Waiver of Rights?

An Extrajudicial Settlement with Waiver of Rights is a notarized document signed by all heirs, where one or more heirs may decide to waive their claim to the estate. It allows the transfer of the deceased’s property to the heirs.

An EJS with Waiver of Rights has the same requirements and process as a regular EJS.

However, it differs in that donor’s tax may be applied depending on the situation:

- Donor’s tax is applied when an heir waives his share in favor of another

- Donor’s tax is not applied when an heir completely waives his share

- Donor’s tax may be applied when a wife waives her share of the conjugal property regime as part of the EJS.

In this article, we briefly go through the requirements and process of an EJS with Waiver of Rights but mostly focus on Donor’s tax.

Contact us for a consultation with an Inheritance Lawyer, if you need help.

What are the requirements for an Extrajudicial Settlement with Waiver of Rights?

The requirements for an Extrajudicial Settlement with Waiver of Rights are all the property documents, all the PSA documents, and the EJS itself.

To be clear, the requirements are:

· All PSA birth, death, marriage certificates and IDs of all the parties

· All property documents and their Certified True Copy such as Land Titles, Tax Declarations, Mortgages, Certificates of No Improvement, and a Certificate of Landholding for the deceased

· All titles for stocks, vehicles, etc.

· Notarized EJS with Waiver of Rights, signed by all heirs and authenticated as applicable.

Now, that sounds simple.

It’s not.

Families don’t have the documents, the documents have issues, or the heirs do not agree and won’t sign the EJS.

(And yes, all heirs have to agree and sign).

This can prevent an estate from ever being settled.

We discuss a lot of these common problems in our post on Extrajudicial Settlements.

Our article talks about these issues from a very, very practical standpoint so that you can be helped.

(It can take years to do an EJS if problems are encountered in the documents. Read the post – it will help. If you need personalized advice, you can always contact us later for an Inheritance Lawyer consultation).

What is the process of an Extrajudicial Settlement with Waiver of Rights?

Extrajudicial Settlement with Waiver of Rights follows the regular EJS process:

- Gather the documents

- EJS with Waiver of Rights drafted by an Inheritance Lawyer

- EJS with Waiver of Rights is signed, notarized and authenticated (if heirs are abroad)

- EJS and all supporting documents are submitted to the BIR

- BIR Estate taxes and Donor’s taxes are paid

- Assets are transferred to the new owners

Because of the manual filing at the BIR and each pertinent location and because extra documents may be required at the BIR, please remember that the process can take longer than it looks.

Try to settle within a year or within the period, since afterward late fees are added every year on top of the BIR estate taxes.

And if there are applicable Donor’s Taxes, the Donor’s taxes must be settled within 30 days or face late fees as well.

Is an Extrajudicial Settlement with waiver of rights subject to donor’s tax? Specific Examples below

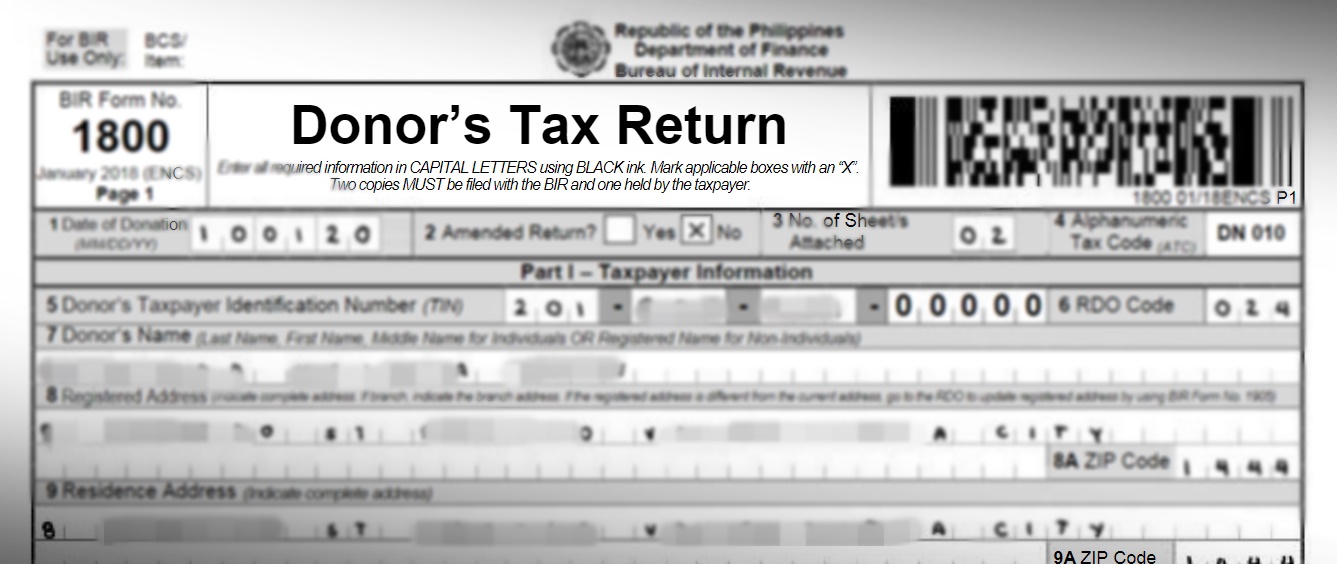

An Extrajudicial Settlement waiver of rights can be subject to donor’s tax, depending on the situation on top of the BIR estate taxes, the Inheritance Lawyer fees, Documentary stamp tax, the transfer fees, the costs of getting the documents and the Accountant’s fees if applicable.

We’ve discussed many of these fees in our articles on Extrajudicial Settlements and BIR Estate taxes depth.

You’ll need to know about these BIR estate taxes since these are applicable in an EJS with Deed of Donation.

There is a significant difference between a regular EJS and an EJS with Waiver of Rights.

The Donor’s tax must be paid within 30 days of the notarization of the document.

If it is not paid, then the donor’s tax is subject to late fees.

I’ll be discussing donor’s tax further down below – specifically when it is applicable.

This is thoroughly discussed in BIR Revenue Regulations (RR) 12-2018 and Revenue Memorandum Circular (RMC) 94-2021.

However, I find that specific examples help people understand better.

Let’s go through 4 specific scenarios below.

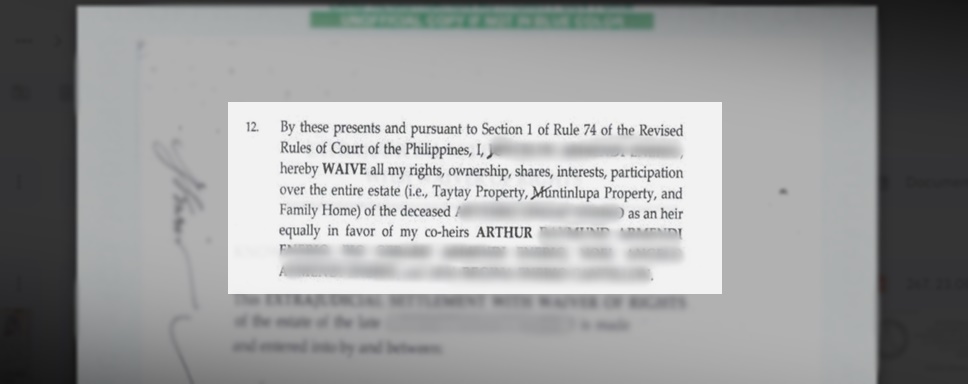

1: An heir completely waives his share in favor of the other heirs.

RMC 94-2021 discusses this in its very first line, “General renunciation of an heir on his share from the inheritance is not subject to Donor’s Tax.”

This is very pertinent for families where some heirs have long left the Philippines.

They sometimes completely waive their share of properties since they cannot administer them. This situation is applicable to them.

2: An heir waives his share in favor of one specific heir.

When an heir waives his share in favor of a specific heir, this transaction is subject to Donor’s tax.

Thus, this Extrajudicial Settlement with Deed of Donation would have both BIR Estate Taxes and Donor’s Tax.

3: Heirs determine specific properties that go to them.

If there are 3 properties and 3 children and the children choose specific properties, there is a donation when the value is in excess of the “should be” share of the inheritance.

In the example up top, each heir should get 2,083,333 of the estate.

However, 2 get more than that and one gets less since specific properties go to each heir.

So, in this specific Extrajudicial Settlement with Deed of Donation, there is Donor’s tax applicable.

4: A legal spouse completely waives his or her interest

A legal spouse waives his or her share of the inheritance and her part of the Conjugal Property in favor of her children.

If a parent passes away and the legal spouse decides to waive both his or her share of the inheritance and the share in the conjugal property in favor of their children, the donor’s tax is applied to the conjugal property donated.

I know that sometimes estate matters can be complicated but hopefully, this has cleared up a lot of your questions.

If your situation is complicated and you need personal advice, you can always contact us for a formal consultation with an Inheritance Lawyer.

2 Comments

Your comment is awaiting moderation.

My mother has passed last year and my father is still with us but wants to sell a property that is under both my parents names, but they are not considered legally married as my mother is the 2nd wife as there is no divorce in the Philippines. How are we to divide the divide the property under the EJS?

Your comment is awaiting moderation.

Have you ever thought about creating an ebook

or guest authoring on other websites? I have a blog based upon on the

same information you discuss and would really like to have

you share some stories/information. I know my visitors would

appreciate your work. If you’re even remotely interested, feel free to send

me an email.

Feel free to visit my web page coinbar

Your comment is awaiting moderation.

Dear Sir/Maam,

The children of the decedents are 9 of them. They have 2 lots containing an area Lot 1- 847sqm and lot 2- 3,133sqm. The six heirs waives their rights in the first lot. While the 3 heirs waives their rights in the second lot. So that we are exempted from paying donors tax, can we make extra judicial settlement with waiver of rights in general? How?

Thank you.

We inherited 2 properties 847 sqm and 3,133 sqm.

We decided that 847sqm go to 3heirs and 3,133sqmgo to 6heirs.we are 9heirs. We did.ejs notarìzed 3yrs ago. But we would like to edit it and make ejs with waiver of rights in general to avoid.donors tax. Could it be.possible?

You will still end up paying estate taxes.

Best to settle this now, because the longer you wait, the more late fees will be added to the estate.

Your comment is awaiting moderation.

March 20,2023

My father died ahead of my mother on July 2, 1998. He and my mother co-own a 150 sqm. lot. What is the legal sharing of their estate at the time of his death with four children? On Aug. 23, 2014 my brother predeceased my mother who passed away on Nov. 22, 2016. How much should go to his three remaining children and the two daughters of my deceased brother?

A daughter of my deceased brother says their share must be the same with us in the Extra Judicial Settlement.

Your legal advice is highly appreciated. Thank you.